Swiss National Bank unpegging Swiss franc from euro has made the gold market bullish once again. Swiss franc was considered to be a safe haven currency and valued much for its stability. But now there seems to be a dent in it. Many analysts are calling Swiss National Bank sudden decision to unpeg Swiss franc from euro amateurish that is going to haunt it in the future. Gold and silver are surging. After a 2% spike in gold yesterday, it was up another 1% or so to $1,276 per ounce near 11 am ET. Silver jumped 1.4% to $17.32 an ounce.

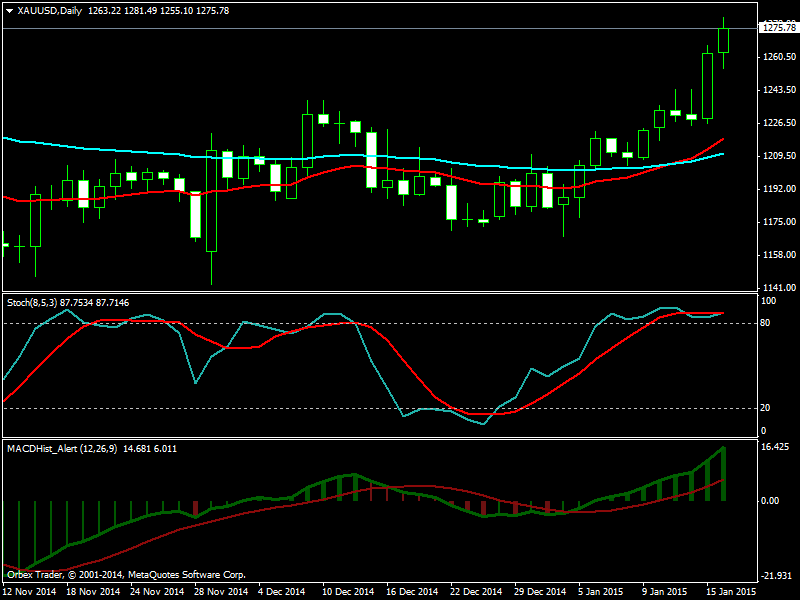

An about-face by the Swiss National Bank catapulted gold prices to a four-and-1/2 month high as investors sought the safety of the yellow metal. Gold futures rose $26, or 2.1%, to $1,260 an ounce in recent trading. The SPDR Gold Shares exchange-traded fund (GLD) rose 2.6% to $121. The move put GLD right at its so-called 200-day moving average, a medium-term technical pivot point. ETFs that own miner stocks got lift from gold’s rise. The Market Vectors Gold Miners ETF (GDX) rose 6.2% in recent trading.

Why the market got shocked by the Swiss National Bank decision? Just one month back, Swiss National Bank had issued a statement that it will vigorously defend the 1.20 Swiss franc to 1 euro peg. So analysts are saying this sudden about face by the Swiss National Bank will damage their credibility.

For the second straight day, gold’s reaction to global events caught trader Guy Adami’s eye. “I think the gold market wants to go higher. I think there’s definitely a blue sky there,” Adami said.