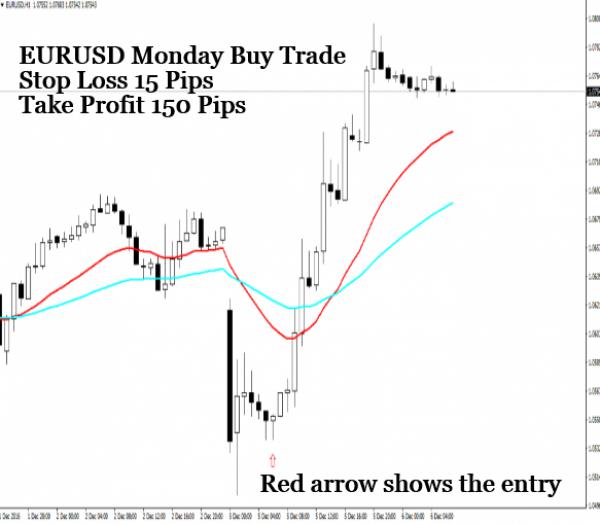

EURUSD opened on Monday with a huge gap down. Over the weekend, Italian Referendum was held that gave a resounding no vote to the governments proposed constitutional reforms. EURUSD was nervous in the early morning hours on Monday. Then the huge EURUSD rally started as the market liked no vote in the referendum. Did you read the last post on GBPUSD Flash Crash? Take a look at the following screenshot.

As you can see in the above screenshot, EURUSD opened with a huge gap down on Monday. After a few candles we realized what EURUSD was planning to do. So we opened a long trade with a stop loss of 15 pips. Red arrow shows the entry candle. Did you download Fibo Pivot Point Indicator? You can see it is a bullish candle and is well above the low made by the H1 candle made a few hours earlier. So we opened a buy trade when this candle closed and placed the stop loss 1 pip below the low of this candle. Entry price as 1.05523 and the stop loss was placed at 1.05370. Take profit target was 150 pips. This gave an excellent reward to risk ratio of 10:1. After that the trade was set and forget. Take profit target was hit after 14 hours before the close of the NY Market Session.

If you have been reading our Forex News blog, then you must have by now understood our trading strategy. We focus more on risk management then on profit targets. We only open a trade when the risk is between 10-20 pips and the take profit target is something like 100-200 pips. 100-150 pip movement are easy to capture. 200 pips move take time and most of the time can involve a retracement. Did you read this month issue of FX Trader Magazine?

Our trading strategy only need a winrate of 70% to make 1000 pips per month. Everytime we focus on the risk and the risk to reward ratio. Risk to Reward Ratio also known as R/R ratio should be at least 1/10 for each trade. Focus on this and focus on risk management and you will find that your trading will become consistent. The difficult part is watching the charts and waiting for the signal. But you don’t need to do that. We only watch H4 candle and if we find the pattern that we trade, then we look for the H1 candle for entry. So you don’t need to watch the charts continuously.

Only watch H4 chart. Watch the close of each H4 candle during the London and the US Market Hours. Don’t bother about the Asian Market Hours. Liquidity is low during Asian Market Hours and most of the time you are going to find false breakouts during Asian Market Hours. Most breakouts that take place during the London and US Market Hours are real. Did you take a look at our Bayesian Statistics For Trader Course? Learning Bayesian Statistics can help you a lot in improving your trading strategy. You make a guess that the market is going to move 200 pips up. Then you use Bayesian Statistics that uses the data to confirm or reject your guess. This is how you can make your trading much more accurate.

Keep your trading strategy as simple as possible. As said just above focus on risk management and R/R ratio and you will see you will win more and lose less. Losing is inevitable. If you start chasing each speeding car, of course you will get hit by the car more often. So avoid overtrading. Just focus on making between 500-1000 pips per month with a low risk. Good Luck!