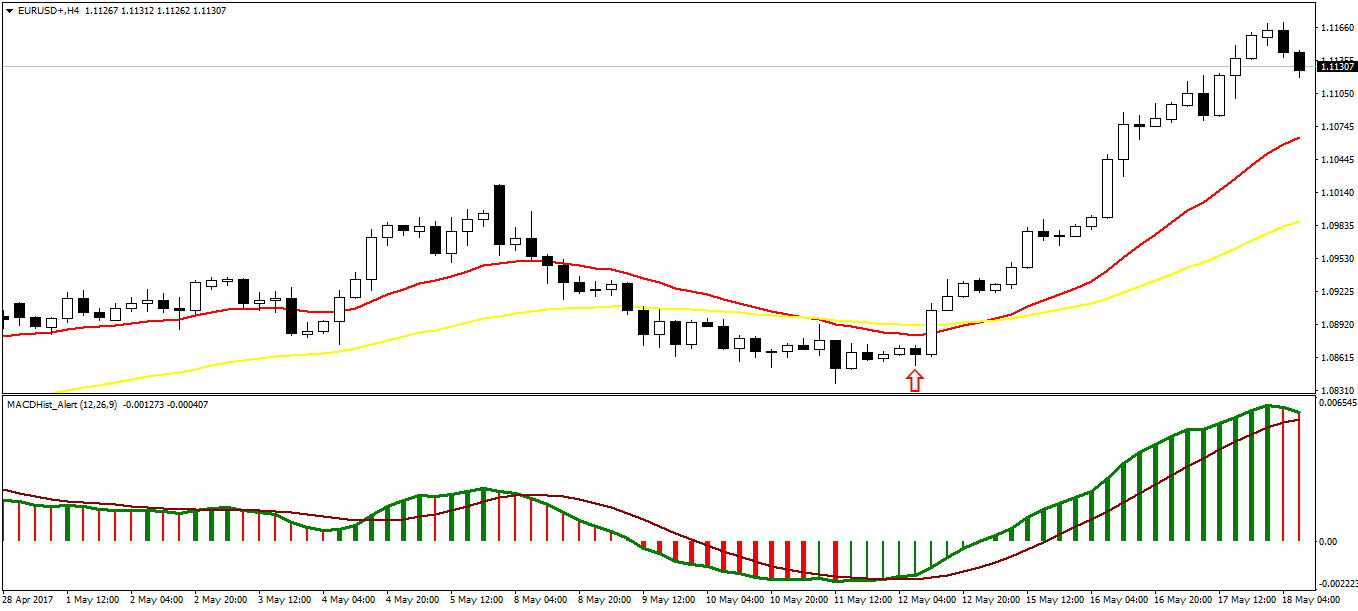

If you have been reading my Forex News 2.0 blog, you must have realized by now, I take risk management very seriously. Most new traders ignore risk management. After many months of losing months, they realize their mistake. Always take risk management very very serious. Did you read the post on GBPUSD short trade with 15 pip stop loss and 200 pip take profit target. In this new post, we look at a recent EURUSD buy trade. This EURUSD long trade had a stop loss of 10 pips and take profit target of 150 pips. This trade had an excellent Reward/Risk ratio of 15:1. Take a look at the following screenshot.

In the above screenshot, can you see the red arrow? This is the entry. You can see MACD has changed color and is showing upward momentum in price. Changing of MACD color is an indication that the trend has changed. We only look for an entry when the trend change is confirmed by MACD. I never try to catch the top or bottom. If you do that you will lose a lot. I have done that and lost a lot. Ultimately I realized that it was a better idea to first let the trend change and confirm it before you open a new trade. So MACD is saying that the trend has changed in the up direction. This is a signal to look for a long trade. I get the opportunity with the candle just above the red arrow. My entry is 1.08638 and the stop loss is 1.08538. So the risk is only 10 pips. Did you read this month issue of FX Trader Magazine? You can read this magazine free on the website. It contains good articles on technical as well as fundamental analysis that can help you a lot in improving your trading performance.

Always Use Pending Order For Entry

Many traders use market orders to enter the market. Using market orders is a bad strategy that most of the time will force the trader to enter the market 10-20 pips above or below the intended entry price. Always use pending buy limit or pending sell limit order. In this case I had used a pending buy limit order with entry price of 1.08638. Stop loss was at 1.08538 just 1 pip below the low of the entry candle. My take profit target is 150 pips. This translates into a price of 1.10138. This take profit target was hit after 2 days on the 3rd day. So you should always use pending limit orders when entering the market. This will always help you achieve a better stop loss. In this case we were able to achieve a stop loss of 10 pips. I use candlestick patterns in deciding when you enter the market. Watch this video on the important candlestick patterns.

Regarding the profit target, sometimes the market doesn’t cooperate. In that case you can close the trade earlier. When you open a trade, there are always only 3 outcomes. The first is stop loss getting hit. In this case you are out of the market with a loss equal to the stop loss that you had used. The other possibility is that market moves in your direction but fails to hit the take profit target. In this case you can always close the trade earlier. The third possibility is for the price to hit profit target. In this case you are extremely lucky. Now if you have studied probability theory in your school or college what this means is that every trade has got only 1/3 chance of winning. You can also state this as saying that there is only 33% chance of you winning a trade.As said above I use candlestick patterns in making the entry decision. I also use candlestick patterns to decide about my profit target. Watch this webinar recording on how to use candlesticks in projecting profit targets.

Always Focus on Reward/Risk Ratio

So keep this in mind. There will never be 100% chance of you winning a trade. Always the probability of winning a trade will be 33%. How do you deal with this low probability of winning a trade? We deal with this low probability of winning a trade by taking risk management very seriously and focusing on Reward/Risk ratio. In the beginning of this post, I had stated that this trade had a Reward/Risk ratio of 15:1. Reward is the amount of pips that you expect to make. Risk is your stop loss. Both of these things, reward in terms of number of pips that you expect this trade to make and risk in terms of number of pips that you are willing to lose if you lose the trade, are already determined when you enter into a trade. Yes when you open a trade you should have a very clear Reward/Risk ration in your mind. Watch this webinar recording on what makes a successful trader despite losing a lot.

This is what I do. I never open a trade that has a Reward/Risk ratio of less than 5:1. There are many traders who are happy with 1:1 R/R. There are other traders who thing 2:1 R/R is very good. But I have through experience fixed my R/R to at least 5:1 when you open a trade. This R/R helps a lot in trading. Suppose you have an R/R of 5:1 on average. Suppose your average stop loss is 20 pips and your average Reward is 100 pips according to this R/R of 5:1. Your average winrate is 80%. What this means is that in 10 trades on average you win 8 trades and lose 2 trades. Losing 2 trades means you loss 20+20=40 pips while winning 8 trades means you make 800 pips. This translates into a net profit of 760 pips which is very good. Read this post on a USDCAD trade that made 150% return.

So you can see choosing trades with a good R/R will give you better trades. Suppose your winrate is only 50% In this case out of 10 trades, on average you lose 5 trades and you win 5 trades. Losing 5 trades means you lose 100 pips and winning 5 trades means you make 500 pips. So your net profit is 400 pips. Even with this low winrate of 50%, you have been able to make a good profit when you R/R is 5:1. Choosing a high R/R can help you when you are losing a lot. Just winning 1-2 trades can recover all your losses. So when you are trading, focusing on a high R/R. How I do it? I use candlestick patterns a lot in my trading. You can read this post on a EURUSD Monday Long Trade with SL of 15 pips and TP of 150 pips.