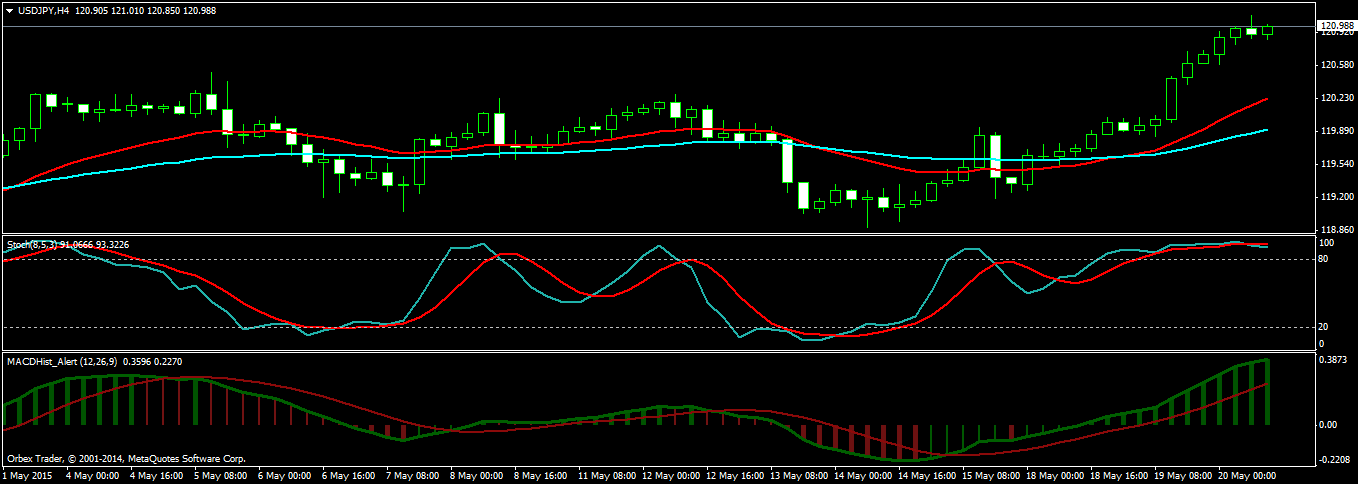

USDJPY is notorious for ranging a lot. But not this time. USDJPY has jumped up around 250 pips in the last 3 days as US Dollar surges for a third day against other currencies like Euro and Yen. Take a look at the screenshot below!

It was a very nice trade with a small risk of 30 pips and a reward of 200 pips giving an excellent reward to risk ratio of 7:1.

Now today is the FOMC day. Expect USDJPY to lose all the gains that it has made. This is how these currency pairs behave. You have to be ever vigilant to ensure that you close the trade well in time before price reverses direction. USDJPY gives low risk trades. But the problem is most of the time it doesn’t move much. It just loves to trade in a range. This is what BOJ wants it to do.

When BOJ wants this pair to move, it makes it move. So if you are trading USDJPY you should always keep a close watch on what the BOJ and the FED is doing. Always make sure to check economic news calender for major USD and JPY news releases.